Municipal Hotel Occupancy Tax Reporting

Overview

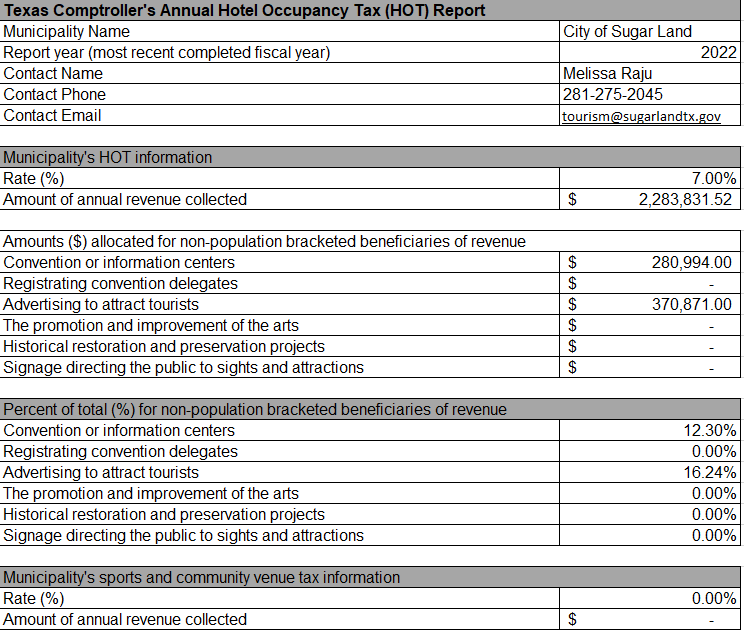

In the early 1970s, the Texas Legislature authorized municipalities to begin collecting the local hotel occupancy tax (HOT). In 2017, the 85th Legislature passed Senate Bill 1221 with the intent of increasing local government transparency while also allowing the public to better understand the state’s patchwork of municipal HOTs. To comply with Tax Code Section 351.009, municipalities that impose certain HOTs now must annually report their tax rates and revenue amounts, including the percentage of revenue allocated for specific uses, from the preceding fiscal year. Below is Sugar Land’s FY22 Municipal HOT report.

Fiscal Year 2022 Municipal HOT Report for Sugar Land, Texas

Make sure to follow us on Facebook, Twitter, and Instagram for all the latest news on things happening in Sugar Land. Our handle is @VisitSugarLand. Tag us in your posts and share your experience: #VisitSugarLandTX, #SweeterInSugarLand. For more information, contact us at (281) 275-2045 or tourism@sugarlandtx.gov.

Visit Sugar Land Convention & Visitor Services

Cookies are used for measurement and optimization. By continuing to use our site you agree to our privacy policy.